2nd Peak and Early Detection

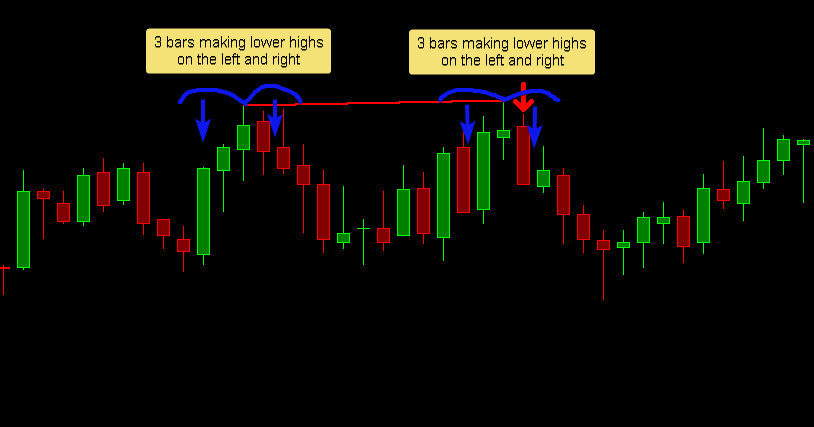

The 2nd peak actually has 2 sensitivity values: 2nd peak left and 2nd peak right. The reason for that is to allow for a mix of detecting peaks that have advanced enough in one direction but to get an early alert without having to wait for the full pattern to form (see the images below for an example.

Early Detection

Because the 2nd peak's right side sensitivity controls how quickly a peak is detected, the Trigger Sensitivity input controls just that. Lower values means sooner detection of divergence, but more false positives on short swings.

Divergence Lookback

Divergence is detected between two swings. The study is limited in how many peaks it can look back through for divergence through the Divergence Lookback Number of Peaks input. If there are multiple peaks that divert in the lookback it selects one according to the Divergence Lookback Use Nearest/Furthest Peak input.

Filters

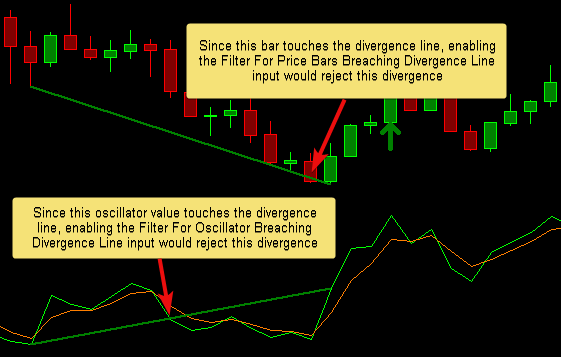

Filter for Bars/Oscillator Crossing Divergence Line

Inputs

| Input name | Description |

|---|---|

| Oscillator | Reference to the subgraph we want to detect divergence with |

| Draw Divergence Lines On | Select whether to draw the actual divergence lines on the main price panel and/or the oscillator region |

| Oscillator Graph Region | The graph region of the oscillator |

| Sensitivity 1st Peak | Number of bars sensitivity for the left side swing (see more below) |

| Sensitivity 2nd Peak Left | Number of bars sensitivity on the left hand side of the right peak |

| Sensitivity 2nd Peak Right | Number of bars sensitivity on the right hand side of the right peak |

| On Bar Close | Should the divergence be detected on bar close or intrabar |

| Arrow Offset | Visual offset in ticks of the arrow from the bar |

| Mode | Select between Regular and Hidden Divergence |

Subgraphs

| Subgraph | Description |

|---|---|

| Bullish Divergence Detected | An up arrow by default, below the bar |

| Bearish Divergence Detected | A down arrow by default, above the bar |

- Note that the detection uses swing points. That means that the right side swing must form in order for the divergence to be drawn. Depending the "Sensitivity 2nd Peak Right" setting, there will be that much delay in detection because we have to wait for the swing to form (Its a classic trade off between waiting for a full price pattern to form vs. earlier detection with patterns that have not fully formed). The arrows will appear on the bar where the divergence was detected. If you look at a historical chart, the arrow shows you when you would have been alerted to the divergence.

Performance and Tuning

To deal with long load times and sluggishness

- Reduce the number of days loaded

- Turn the drawings off

Setting up Alerts

Using the SC built-in alerts, add the alert condition below to the study Alerts Tab

Alert condition: or(SG1<>0, SG2<>0)

| Widget Connector | ||

|---|---|---|

|

More

| Widget Connector | ||

|---|---|---|

|