| Input name | Description |

|---|

| Bullish Divergence Price Reference | Reference to the input data for detecting Swing Lows |

| Bearish Divergence Price Reference | Reference to the input data for detecting Swing Highs |

| Oscillator Reference | Reference to the subgraph we want to detect divergence with |

| Draw Divergence Lines | Select whether to draw the actual divergence lines on the main price panel and/or the oscillator region |

| Oscillator Graph Region | The graph region of the oscillator |

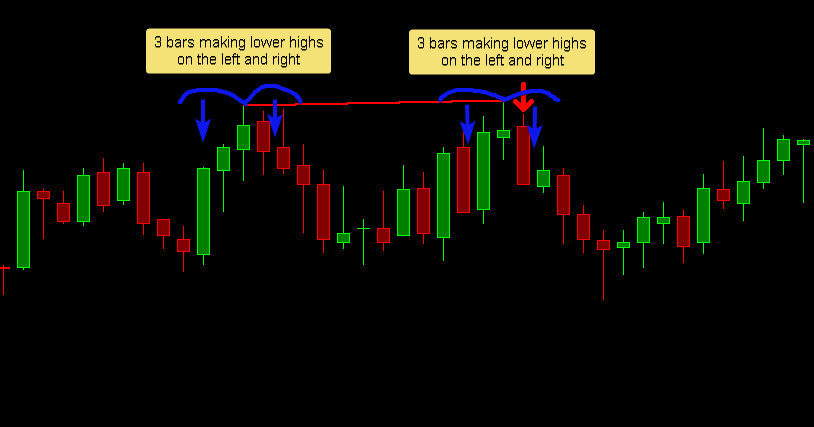

| Swing Sensitivity | Number of bars sensitivity for detecting swings (see Sensitivity Settings) |

| Trigger Sensitivity | Number of bars sensitivity on the right side of the 2nd peak (see Early Detection) |

| On Bar close | Should the divergence be detected on bar close or intrabar |

| Divergence Signal Visual Offset (in Ticks) | Visual offset in ticks from the bar of the arrow marking divergence detection |

| Divergence Types to Detect | Select whether Regular and/or Hidden Divergence types are detected |

| Oscillator Pivot Alignment Enabled | When enabled and a price swing is detected, the study will look back for a swing in the oscillator to use for divergence detection. If no swing is found then the study will not look for divergence. |

| Oscillator Pivot Alignment Lookback | Amount of bars to look back in the oscillator for a swing. |

| Bullish Divergence Line Color | Color for lines drawn for Bullish Divergence |

| Bearish Divergence Line Color | Color for lines drawn for Bearish Divergence |

| Divergence Line Width | Width of lines drawn for Divergence |

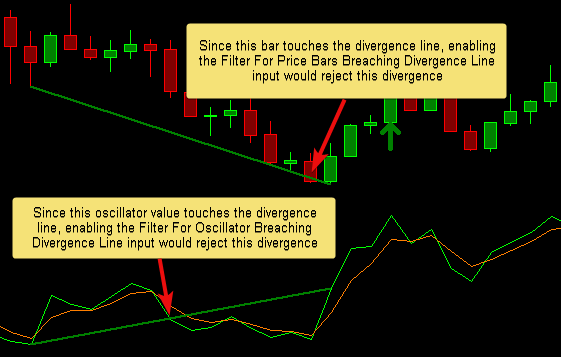

Filter For Price Bars Breaching Divergence Line | Select to filter out price bars that breach the divergence line either with their closing value or any value in-between high and low (see Bars/Oscillator Crossing Divergence Line) |

| Filter For Oscillator Breaching Divergence Line | Select to filter out oscillator values that breach the divergence line (see Bars/Oscillator Crossing Divergence Line) |

| Allow Divergence Line to Span Multiple Trading Sessions | Should divergences be allowed to span multiple trading sessions |

| Divergence Lookback Number of Peaks | Number of peaks to look through for divergence (see Divergence Lookback) |

| Divergence Lookback Use Nearest/Furthest Peak | Select whether to prefer the furthest or nearest diverting peak found in the lookback |

| Divergence Line Slope Filter Minimum Price Difference Units | Select whether to use difference in points or percentage when filtering out divergences that are too small |

| Divergence Line Slope Filter Minimum Price Difference | Minimum difference between two peaks to be considered for divergence |

| Divergence Line Filter Minimum Oscillator Difference | Minimum difference in points between two oscillator values to be considered for divergence |