T29 ATR Bot

Entry Logic

When a signal fires, the following happens:

- Using the ATR and the current price, the stop distance is calculated

- Using the stop distance and the $ Risk value, the entry quantity is calculated

- For each target we need to calculate the quantity and the offset.

- The quantities are distributed using an even distribution (see below)

- The offset is a multiplier of the ATR

- With these values, the bot now submits a market order with a stop and the targets

- User can now manage the trade manually

Distributing Quantities to Targets

Even Distribution

The bot will spread the contracts across the targets evenly.

Taking the example of 7 with 3 targets enabled. The contracts would be distributed like this:

2 would allocated to each target for a total of 6. We then have a remainder of 1. The remainder is allocated starting from Target1 working our way up.

Another example is 8. Again, 2 would be allocated to each target for a total of 6 and remainder of 2. The remainder would be allocated to targets 1 and 2 giving a final distribution of 3,3,2

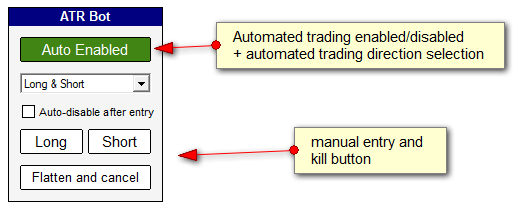

Automated Entry vs. Manual (Enter Now)

There are two ways in which trades can be entered:

Automated - User sets an "Entry Signal Reference". When the signal fires, orders will be placed. The bot must be enabled

Manual - At any time, users can press the Long or Short buttons. This will cause a market entry order with the stop/targets calculated using the current ATR

Notes

- The Enable button - this button is used to switch automated entries on/off. when green and reads "Enabled", automated entries are turned on. When gray and reads "Disabled", automated entries are disabled and signals will be ignored

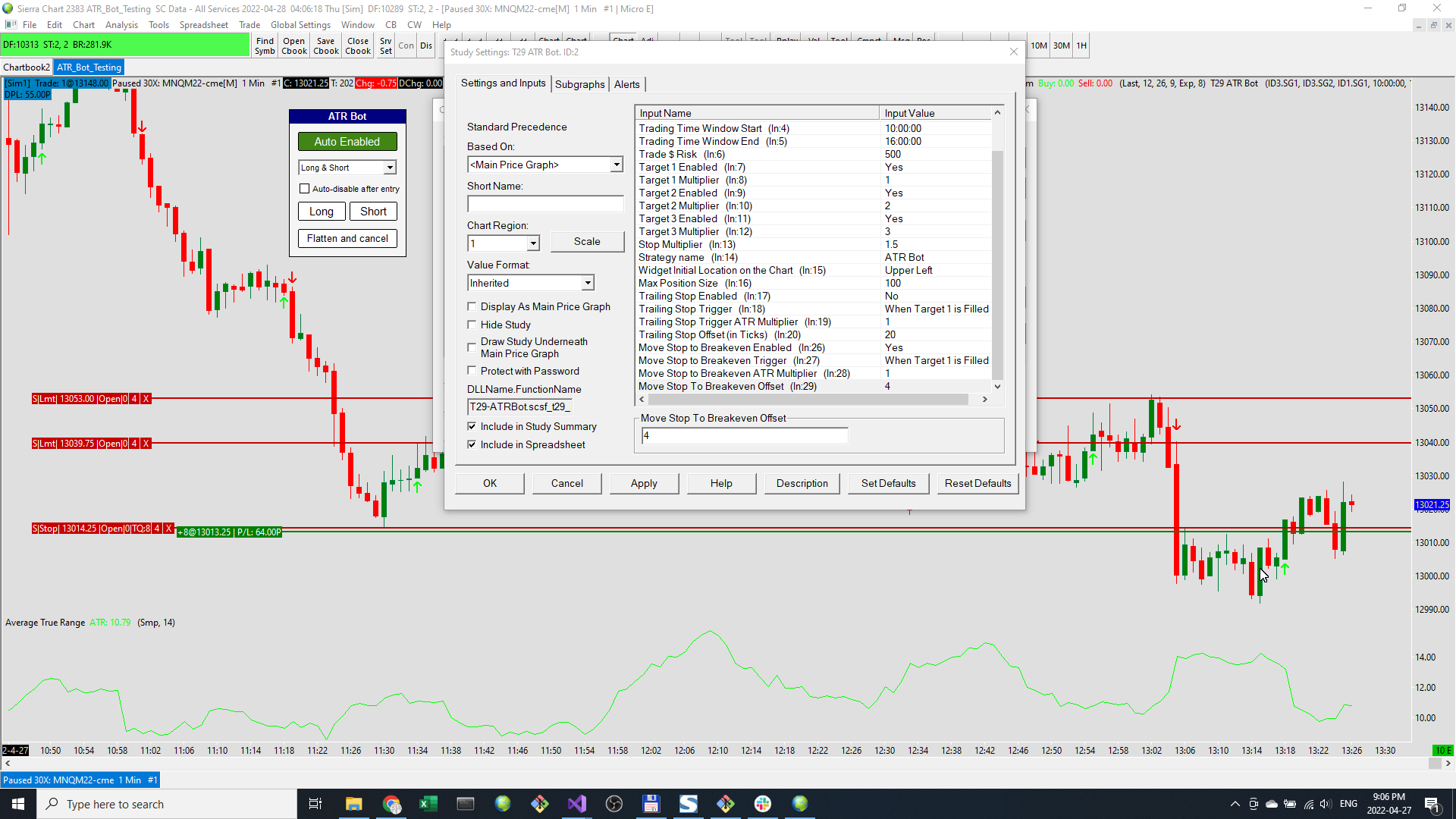

Inputs

- Long Entry Signal Reference, Short Entry Signal Reference - set a reference to a signal. only used with automated trading mode

- ATR Reference - reference to a the ATR study subgraph. Used to calculate stop and target locations as multiples of the ATR

- Trading Window Start Time, Trading Window End Time - set trading times. In automated mode, the bot will only enter trades during these times

- Trade $ Risk - the max amount of risk to take per trade

- Target Settings

- Target 1 Enabled, Target 1 Multiplier

- Target 2 Enabled, Target 2 Multiplier

- Target 3 Enabled, Target 3 Multiplier

- Stop Multiplier

- Strategy Name

- Widget Initial Location on the Chart - when a chart is loaded, sets the initial location of the trade panel

- Trailing Stop Enabled

- Trailing Stop Trigger

- Trailing Stop Trigger ATR Multiplier

- Trailing Stop Offset (in Ticks)

- Move to Breakeven Enabled

- Move to Breakeven Trigger

- Move to Breakeven ATR Multiplier

- Move to Breakeven Offset

Stop Logic

The bot supports a stop with optional move to breakeven and trail.

The initial stop price is based on the stop multiplier.

If a trailing stop is enabled, it will start to trail once the trigger happens.

If a move to breakeven is enabled, the stop will move when the trigger happens.

The stop only moves in the direction of the trade.

There are a few options for the trigger:

- Start Trailing Immediately On Entry

- When Target 1 is Filled

- When Target 2 is Filled

- When ATR Multiplier is Touched